Freephone Helpline

0800 3688 286

Stop Jacobs Enforcement

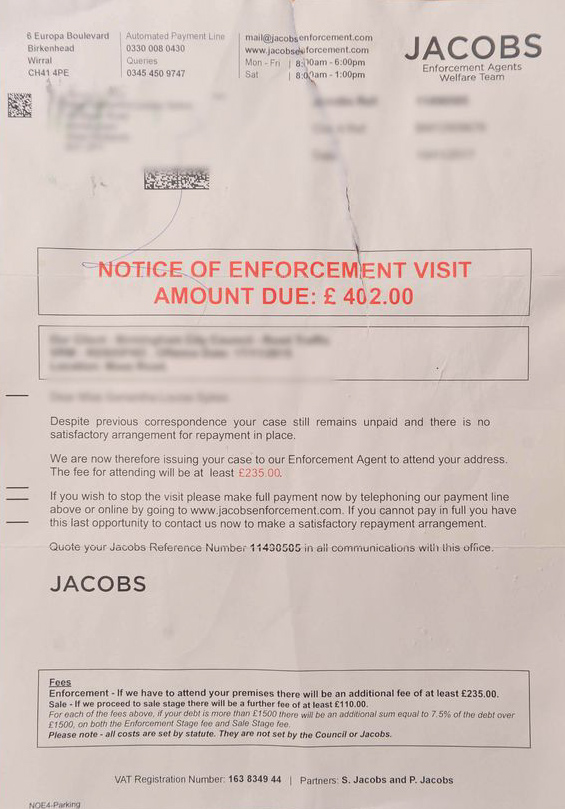

Have you received a letter or text message from Jacobs Enforcement saying they are about to visit your home?

Do you need advice & help on how deal with Jacobs Enforcement?

Are you having problems with Jacobs bailiffs?

Are they chasing you for Council Tax, Business Rates or Parking Tickets?

Are they refusing to accept a repayment plan?

Don't panic, we help people STOP bailiffs everyday

What should I do?

IMPORTANT!!! If a Bailiff is at your door, DO NOT LET THEM IN! You do not have to let them in your house no matter what they say to you. If an enforcement agent is at your door, or has left a visit letter, call the Stop Bailiffs Helpline on 0800 3688 286

now.

If Jacobs enforcement agents have contacted you, it is important that you do not ignore their communications, and that you seek help now. As you get further down the debt collection process, the more difficult the circumstances will become for you.

Stop Jacobs Enforcement Now!

If you need help with Jacobs Enforcement, call the FREE Stop Bailiffs Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and see how you can stop the bailiffs.

If you have received a letter or calling card from a bailiff claiming that you have an outstanding debt or if you’ve been visited by Jacobs bailiffs the best thing to do is to call the Bailiff Helpline immediately.

We can provide advice, free of charge. We will speak to the Bailiff on your behalf, and can arrange for a temporary hold on Bailiff action, whilst the problem is sorted out.

Who are Jacobs Enforcement?

Jacobs Enforcement Agents (previously called bailiffs) hold a certificate, which is granted by a judge at the county court, this certificate allows them carry out enforcement action.

All enforcement agents are regulated by the Ministry of Justice.

Jacobs provide Enforcement and Debt Collection Services for 203 Councils in England and Wales.

They collect Council Tax, Business Rates, Parking Penalty Charge Notices and Commercial Rent Arrears.

They also have a sister company called Credit Security. This is a debt collection agency that collects debts relating to overpaid housing benefit and rent arrears.

Are they legitimate?

You can check whether the bailiff is registered at the Certificated Bailiff Register

This register holds details of all enforcement agents (previously called bailiffs) who hold a certificate, granted by a judge at the county court. You can search by an enforcement agent's or applicant's name.

Only "fit and proper" individuals should hold these certificates.

If you know of serious conduct issues which would mean that an existing enforcement agent, or an applicant for a certificate, is not a "fit and proper" person, you can use this register to find out which court you should alert to these issues.

If you have any concerns or doubts over the bailiff please call us on 0800 3688 286 and we will check if they are real for you.

Enforcement Officer and Bailiff Scam

We have become aware of scammers phoning members of the public, posing as County Court bailiffs, High Court Enforcement Officers (HCEOs) and Certificated Enforcement Agents (CEAs).

In a number of cases they are claiming to be a bailiff at Northampton County Court.

Please stay vigilant against fraudsters posing as enforcement officers and bailiffs, for more information please visit; https://www.gov.uk

If you have any concerns or doubts over the bailiff please call us on 0800 3688 286 and we will check if they are real for you.

If you need help with Jacobs Enforcement, call the FREE Stop Bailiffs Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and see how you can stop the bailiffs.

What can they do?

They have the legal power to remove and sell your belongings to pay a debt you owe. In most cases, bailiffs only get involved after your creditor has taken you to court.

If you let a bailiff into your home they can take:

They can not take:

Proving that the items don't belong to you isn't always easy.

Call the Bailiff Helpline on 0800 3688 286 if you need help with this.

If Jacobs bailiffs have taken your goods.

If the bailiff has taken your goods you can still get them back, but you will have to:

- Settle your debt before the goods are sold by Jacobs.

- Make an agreement with your creditor and get them to ask Jacobs Enforcement to return your goods.

- You buy the goods back yourself.

- The Jacobs bailiff did not follow the correct procedure when they took your goods.

Can Jacobs take my car?

Cars are one of the most popular things for a bailiff to seize. This is because they usually have value, are easy to seize and also for the bailiff to sell on.

Bailiffs are allowed to take cars and vehicles, but they have to follow certain rules.

- A Bailiff can only take control of a vehicle that's actually owned solely or jointly by the debtor.

- A car belonging to a third-party cannot be taken. So if your car is on a HP agreement they can not take it.

- A car displaying a Blue Disabled Badge cannot be taken.

Alternatively, the bailiff may leave the car with you as long as you to sign a controlled goods agreement, this means you promise that you won't try to sell or get rid of the vehicle and agree to a payment plan. If you don't keep to the terms of this repayment plan, the bailiff will come back and seize your vehicle.

Call the Bailiff Helpline on 0800 3688 286 if you need help.

The bailiff has clamped my car, can I remove it?

No, do not remove the clamp from your vehicle. Under section 68.1 of Schedule 12 (TCEA 2007) it is a serious offence to remove a wheel clamp or to obstruct the bailiff from clamping or removing the vehicle. You risk being fined or sent to prison for a term not exceeding 51 weeks!

Top Tip: Hide your car

If you don't want your car to be taken, you can park it on private land, such as a friend's driveway or a car park. A bailiff can take your car if it is parked on a public highway, but they can't take a car parked on private land belonging to someone else without a court order.

What can they charge?

How much the bailiff can charge will depend on your situation.

The fees that a Jacobs bailiff/enforcement agent can charge are outlined under the Taking Control of Goods (Fees) Regulations 2014.

There are three separate stages of baliff action, called compliance, enforcement and sale of goods.

Jacobs are therefore allowed to charge a fee for each stage of the process of taking action against you.

However, the bailiff fees can only be charged once for each stage of the process, no matter how much work was involved in that stage of the process. So even if a bailiff had to visit your home four times during the enforcement stage, they can only charge the enforcement fee once.

The fees can quickly add up though, and we think the £75 fee for issuing the "enforcement notice", which is basically just a standard letter, is excessive.

For each stage the bailiffs can charge two fees, as detailed in the table below:

| Stage of collection | Bailiff Action | Fixed Fee | % Fee (over £1500 only) |

|---|---|---|---|

| Compliance | Sending you an enforcement notice through the post, requesting payment. | £75 | 0% |

| Enforcement | Visiting your home or business premises to take control of goods. | £235 | 7.5% |

| Sale of Goods | Removing and selling your goods/belongings. | £110 | 7.5% |

So if you have received an "enforcement notice" from Jacobs through the post, don't ignore it. If you do not contact them they will proceed to stage two and charge you another £235, when they send a bailiff to knock on your door.

It may not be too late for you to negotiate a payment scheme with a bailiff on your own.

However, we suggest that you contact us immediately for free advice, we can easily deal with Jacobs Enforcement for you.

Call the Bailiff Helpline on 0800 3688 286

If you want more help on dealing with Jacobs Enforcement, call the FREE Bailiff Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and find your best solution.

Other charges they can make.

As well as the fixed fees and percentage fees shown above, you may also be charged by Jacobs for disbursements. These can include the following:

- Storage costs for your belongings after they were taken away by Jacobs Enforcement.

- Locksmith costs.

- Any court fees Jacobs had to pay if they needed to apply to the court at any point.

- Auctioneer's costs if they have sold your goods, including commission of up to 15 per cent of the selling price, out-of-pocket expenses and advertising the sale of your goods.

For all expenses charged by Jacobs, you have the right to see receipts and other evidence for the costs they have added to your bill.

Can I avoid bailiff fees by paying the Council or Magistrate Court direct?

The short answer to this is "NO".

Once a warrant has been passed to the enforcement agency and the enforcement agency has issued a "notice of enforcement", the bailiff fees becomes legally due and the ‘amount outstanding’ will include the bailiff fees.

What time do Jacobs bailiffs work till?

They can attend your property between the hours of 6am and 9pm.

Enforcement should not be undertaken on Sundays, on Good Friday or on Christmas Day.

However they can carry out enforcement outside of these hours under the following circumstances:

- If they have a court order saying they are entitled to operate outside the hours of 6am to 9pm

- If your belongings of value are at a premises that trades outside the hours of 6am to 9pm, at a business premises for example, then the Bailiff can visit during this time. A good example of this would be a pub, restaurant or club.

- If a Bailiff is in the process of seizing your belongings within the hours of 6am - 9pm but they have not finished before 9pm, then they may stay and complete their enforcement.

How can I make a complaint about Jacobs Enforcement?

If you want to complain about a Jacobs Enforcement Agent you should call their head office on 0345 601 2692 or put your complaint in writing to: Compliance Officer, Jacobs Enforcement, 6 Europa Boulevard, Birkenhead, Merseyside, England, CH41 4PE

They have an independent compliance department which will conduct an investigation into every complaint that they receive.

Remember to keep a copy of any letters that you send, so you have an audit trail of what was sent and when.

If you are not happy with their response, or have not received a reply wihtin 30 days you can escalate your complaint to the High Court Enforcement Officers’ Association in the following ways:

- Email your complaint to [email protected]

- Call 0844 824 4575

How many times can a bailiff visit?

We often hear "they can only visit three times then they have to hand the debt back". This is not true. Their is no fixed number of times a bailiff can visit you to try to recover the debt.

However eventually they may return the warrant to the court or local authority if they are unable to gain entry, or you do not have enough goods to pay off the debt and fees.

The ony way to stop visits is to arrange an agreement for the outstanding debt to be paid.

If the bailiff is refusing to accept a repayment plan from you call us on call the FREE Bailiff Helpline on 0800 3688 286 (freephone, including all mobiles)

If you need help with Jacobs Enforcement, call the FREE Stop Bailiffs Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and see how you can stop the bailiffs.

Can I be arrested for not paying a bailiff?

No, a bailiff can not arrest you. They also can not call the police to arrest you unless it is to prevent a breach of the peace. EG you have theatened them with violence.

You cannot be arrested for refusing to allow a bailiff into your home.

You cannot go to prison for not paying your debts. However, non-payment of council tax, child maintenance or magistrates court fines can lead to imprisonment if you 'wilfully refuse' to pay.

This means that you have the money but choose not to pay.

You would be told to attend a magistrates court ‘means enquiry hearing’ before this is decided.

This gives you the chance to explain why you have not paid.

Broken payment arrangement

Jacobs Enforcement will cancel your repayment plan if you miss an agreed payment date or pay less than the agreed amount.

This often happens because the payment plan they forced you too make was simply too high and unaffordable.

Therefore it was only a matter of time until a payment was missed, and they could add more fees onto the job.

If they cancel your payment plan they will move your case to enforcement. This means an agent will visit your home.

They will not offer or negotiate with you to put a new repayment plan in place.

IMPORTANT!!! If this has happened to you call our helpline now on free phone

0800 3688 286

. We can force the bailiffs to accept a new AFFORDABLE repayment plan from you.

If you need help getting a new payment arrangement with Jacobs, call the FREE Stop Bailiffs Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and see how you can stop the bailiffs.

Do Jacobs Enforcement have a free phone number?

Unfortunately they do not have a freephone number

So if you have no credit on your phone you can call us free on 0800 3688 286 and we will help you.

Please note that we are not associated with Jacobs bailiffs in any way. The information on this page is provided to help people contact their creditors.

If you're finding it difficult to make your monthly payments to Jacobs you may need help looking at your budget and managing your debt. We deal with bailiffs all day, every day and we know exactly how to approach them. If you're struggling to repay a debt and would like us to deal with Jacobs Enforcement on your behalf, or simply need a bit of advice, just click on the STOP BAILIFFS NOW button below.

If you want more help on dealing with Jacobs Enforcement, call our FREE Helpline on 0800 3688 286 (freephone, including all mobiles) or take the online debt test and find your best solution.

More Debt Advice:

Which Debts Are Not Included In Bankruptcy?

ReadMost people think that if they go bankrupt, it will get rid off all of their debts. However, this is not always the case. You may still be liable for some debts...

How Long Does It Take To Go Bankrupt?

ReadSo how long does it take to go bankrupt? Bankruptcy can be implemented very quickly but it can vary depending on your individual circumstances...

What Is A Debt Relief Order? (DRO)

ReadWondering if you can get a debt relief order, sometimes referred to as DRO? This section explains what a debt relief order is, and the steps you need to take to apply for a debt relief order...